Under the Fair Labor Standards Act, non-exempt employees are entitled to overtime pay at 1.5 times their regular rate for all hours worked in a workweek in excess of 40. In order to be considered exempt, an employee must be paid a salary in excess of a certain amount and must perform certain job duties, generally of a bona fide executive, administrative, or professional. Currently, the salary basis is $35,568 per year ($684 per week), which was most recently updated in 2019.

On Tuesday, April 23, 2024, the Department of Labor announced its final rule, entitled Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales, and Computer Executives, which significantly increases the salary thresholds below which employees are entitled to overtime compensation. This final rule is based on the proposed rule that was issued in September 2023 and the more than 33,000 comments the DOL received about that proposed rule.

Under the final rule, set to be effective July 1, 2024, the salary necessary to qualify as exempt from overtime compensation will increase to $43,888 annually ($844 weekly) on July 1, 2024, with an additional increase to $58,656 annually ($1,129 weekly) on January 1, 2025. Then, beginning July 1, 2027, the salary threshold will automatically update every three years. In addition, the salary threshold for highly compensated employees will be raised from its current level of $107,432 annually to $132,964 on July 1, 2024 and to $151,164 on January 1, 2025. The final rule does not change the job duties test, which will still need to be met in addition to the salary basis test in order for an employee to be considered exempt.

If this final rule goes into effect, it is estimated that more than 3 million workers will be affected. However, it is likely that the final rule will be challenged in court, just as other updates to the salary basis test have been challenged (and sometimes struck down) in the past. Given the short timeline before the initial increase, employers should begin preparing now to evaluate what they will need to do if the final rule does go into effect on July 1, 2024. As always, O’Neil Cannon is here for you. We encourage you to reach out with any questions, concerns, or legal issues you may have regarding your labor and employment policies and practices.

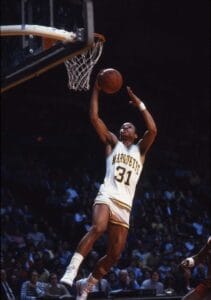

In the summer of 1982, when Glenn “Doc” Rivers was a student-athlete at Marquette University, he was a messenger at our firm, running errands and playing on the firm’s softball team (he pretty much covered the entire outfield). Likely due to the tremendous training and experience he received from our firm, Doc has had great success since then. He played in the NBA for 14 years; has been a head coach in the NBA for 25 years; won an NBA championship; was named Coach of the Year in the NBA; and is now the head coach of the Milwaukee Bucks. Welcome back to Milwaukee, Doc. It was clear to us way back in 1982 that Doc was destined for great things.

In the summer of 1982, when Glenn “Doc” Rivers was a student-athlete at Marquette University, he was a messenger at our firm, running errands and playing on the firm’s softball team (he pretty much covered the entire outfield). Likely due to the tremendous training and experience he received from our firm, Doc has had great success since then. He played in the NBA for 14 years; has been a head coach in the NBA for 25 years; won an NBA championship; was named Coach of the Year in the NBA; and is now the head coach of the Milwaukee Bucks. Welcome back to Milwaukee, Doc. It was clear to us way back in 1982 that Doc was destined for great things.