Each year, Super Lawyers surveys the State of Wisconsin’s 15,000 attorneys and judges, seeking the State’s top attorneys. Recently, Super Lawyers published its lists for 2023, which include the Top 10 Attorneys in Wisconsin, Top 50 Attorneys in Wisconsin, Top 25 Attorneys in Milwaukee, Super Lawyers (consisting of the top 5% of attorneys in Wisconsin), and Rising Stars (consisting of attorneys who are 40 years old or younger or who have been in practice for 10 years or less).

Twenty-nine of our attorneys were recognized by Super Lawyers, which has referred to the firm as “the Milwaukee mid-sized powerhouse.” Those attorneys are the following:

- Jean Ansay:

- Nicole Beitzinger:

- Pat Bomhack:

- Nick Chmurski:

- Doug Dehler:

- Jim DeJong:

- Seth Dizard:

- Top 50 Attorneys in Wisconsin

- Top 25 Attorneys in Milwaukee

- Super Lawyer

- Pete Faust:

- John Gehringer:

- Joseph Gumina:

- Jessica Haskell:

- Carl Holborn:

- Mike Kennedy:

- Grant Killoran:

- Dean Laing:

- Top 10 Attorneys in Wisconsin

- Top 50 Attorneys in Wisconsin

- Top 25 Attorneys in Milwaukee

- Super Lawyer

- Trevor Lippman:

- Greg Lyons:

- Patrick McBride:

- Britany Morrison:

- Joe Newbold:

- Erica Reib:

- Chad Richter:

- Ryan Riebe

- John Schreiber:

- Jason Scoby:

- Steve Slawinski:

- Kelly Spott:

- Christa Wittenberg:

Super Lawyers is a national rating service that rates attorneys in all 50 states. The selection process utilized by Super Lawyers is multi-phased and includes independent research, peer nominations, and peer evaluations. One court recently had this to say about Super Lawyers:

“[T]he selection procedures employed by [Super Lawyers] are very sophisticated, comprehensive and complex. It is abundantly clear . . . that [Super Lawyers does] not permit a lawyer to buy one’s way onto the list, nor is there any requirement for the purchase of any product for inclusion in the lists or any quid pro quo of any kind or nature associated with the evaluation and listing of an attorney or in the subsequent advertising of one’s inclusion in the lists.”

We are proud to be one of the few firms in Wisconsin that had more than 50% of its attorneys receive recognition by Super Lawyers.

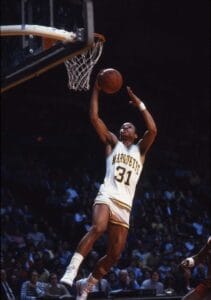

In the summer of 1982, when Glenn “Doc” Rivers was a student-athlete at Marquette University, he was a messenger at our firm, running errands and playing on the firm’s softball team (he pretty much covered the entire outfield). Likely due to the tremendous training and experience he received from our firm, Doc has had great success since then. He played in the NBA for 14 years; has been a head coach in the NBA for 25 years; won an NBA championship; was named Coach of the Year in the NBA; and is now the head coach of the Milwaukee Bucks. Welcome back to Milwaukee, Doc. It was clear to us way back in 1982 that Doc was destined for great things.

In the summer of 1982, when Glenn “Doc” Rivers was a student-athlete at Marquette University, he was a messenger at our firm, running errands and playing on the firm’s softball team (he pretty much covered the entire outfield). Likely due to the tremendous training and experience he received from our firm, Doc has had great success since then. He played in the NBA for 14 years; has been a head coach in the NBA for 25 years; won an NBA championship; was named Coach of the Year in the NBA; and is now the head coach of the Milwaukee Bucks. Welcome back to Milwaukee, Doc. It was clear to us way back in 1982 that Doc was destined for great things.